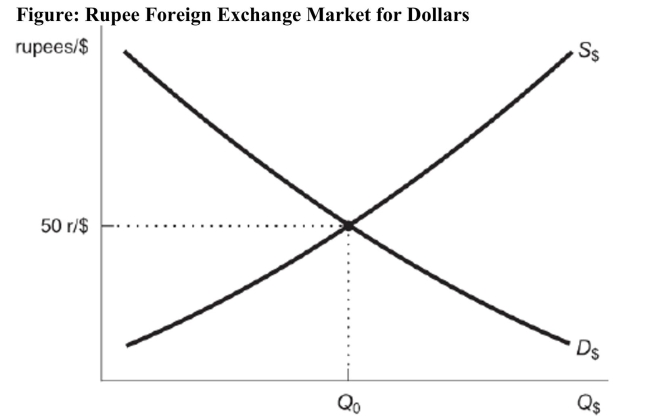

Reference: Ref 20-5 (Figure: Rupee Foreign Exchange Market for Dollars) Use the figure to answer this question: Suppose war breaks out in India, and there is a great deal of political instability. Which of the scenarios would likely occur in the rupee/dollar foreign exchange market? I. The demand for U.S. dollars would shift to the right. II. The demand for U.S. dollars would shift to the left. III. The supply of U.S. dollars would shift to the right. IV. The supply of U.S. dollars would shift to the left.

Reference: Ref 20-5 (Figure: Rupee Foreign Exchange Market for Dollars) Use the figure to answer this question: Suppose war breaks out in India, and there is a great deal of political instability. Which of the scenarios would likely occur in the rupee/dollar foreign exchange market? I. The demand for U.S. dollars would shift to the right. II. The demand for U.S. dollars would shift to the left. III. The supply of U.S. dollars would shift to the right. IV. The supply of U.S. dollars would shift to the left.

Definitions:

Tax-Effect Adjustment

Adjustments made to account for the tax implications of differences between accounting and tax treatments of items, ensuring financial statements reflect future tax liabilities or assets.

Intragroup Services

Services provided by one entity within a corporate group to another entity within the same group.

Statement of Financial Position

A financial statement that reports a company's assets, liabilities, and shareholders' equity at a specific point in time, providing a basis for computing rates of return and evaluating its capital structure.

Identifiable Assets

Identifiable assets are those assets of an acquired company that can be separated from the company and sold, transferred, licensed, rented, or exchanged, including assets that can be contractually used or shared.

Q10: If, in the best case scenario, increased

Q11: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3375/.jpg" alt=" Reference: Ref 4-2

Q37: Suppose the Fed reacts to an economic

Q48: Which of the following is the correct

Q50: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3375/.jpg" alt=" A) an increase

Q83: A relatively loose commitment to a floating

Q95: Taxes lead to a loss of beneficial

Q115: Transactions included in the balance of payments

Q116: Foreign aid is a net addition to

Q125: Why did Greenspan receive criticism during the