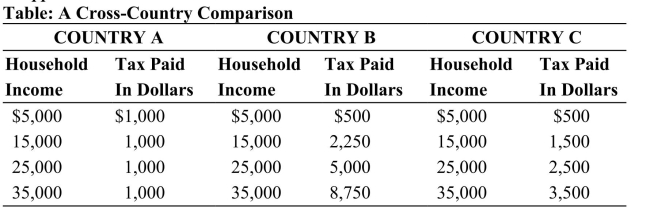

This table shows data on taxes paid by three individuals living in each of three countries: A, B, and C. The tax paid in dollars is based on the marginal tax rates assessed in each of the three countries. Assume that each individual earns an income of exactly $37,000, and there are no deductions or exemptions that need to be applied.  Reference: Ref 17-2 (Table: A Cross-Country Comparison) According to the data in the table, which country has a flat tax rate system?

Reference: Ref 17-2 (Table: A Cross-Country Comparison) According to the data in the table, which country has a flat tax rate system?

Definitions:

Attribution Style

A concept in psychology that refers to how individuals explain the causes of behavior and events, often categorized into internal (dispositional) or external (situational) attributions.

Fundamental Attribution Error

A cognitive bias that involves overestimating the effect of personality and underestimating the influence of situational factors when explaining others' actions.

Weiner

Refers to Bernard Weiner, a psychologist known for his work on attribution theory, which deals with how people interpret and attribute causes to events and behaviors.

Past Experiences

Events or situations that have occurred in an individual's life history and can influence their current behavior and decisions.

Q5: Which of these would help a government

Q12: Gains from trade are maximized when:<br>A) the

Q25: Assume that an initial real exchange rate

Q26: The main difference between M1 and M2

Q37: What can explain the positive relationship between

Q38: If consumers believe a tax rebate is

Q72: In 2010, federal government taxation made up

Q77: A positive real shock will increase real

Q79: An insolvent bank has greater liabilities than

Q97: Households in the top 20 percent of