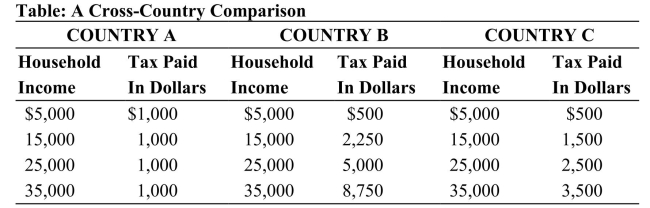

This table shows data on taxes paid by three individuals living in each of three countries: A, B, and C. The tax paid in dollars is based on the marginal tax rates assessed in each of the three countries. Assume that each individual earns an income of exactly $37,000, and there are no deductions or exemptions that need to be applied.  Reference: Ref 17-2 (Table: A Cross-Country Comparison) According to the data in the table, which country has a regressive tax rate system?

Reference: Ref 17-2 (Table: A Cross-Country Comparison) According to the data in the table, which country has a regressive tax rate system?

Definitions:

Q3: Technological advances have increased the supply of

Q4: Assume that because the government cancels a

Q4: A country with a negative current account

Q21: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3375/.jpg" alt=" Reference: Ref 4-2

Q22: The federal tax system assists people below

Q44: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3375/.jpg" alt=" Reference: Ref 15-3

Q68: If the Fed buys government bonds, then

Q90: President Bush favored increases in government spending

Q95: An economy with a 1 percent Solow

Q124: When the Fed increases the money supply