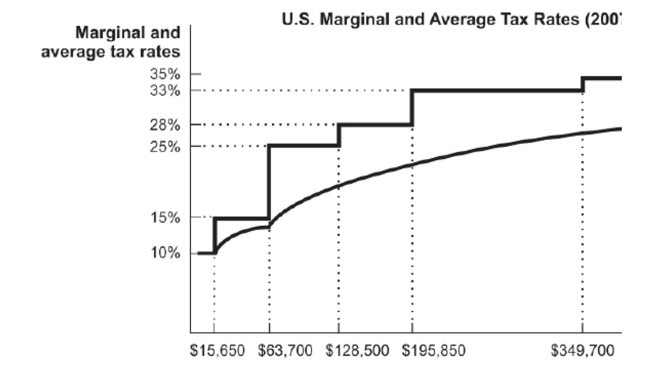

Figure: U.S. Marginal and Average Tax Rates  Reference: Ref 17-1 (Figure: U.S. Marginal and Average Tax Rates) According to the figure, an individual who earns $150,000 a year has an approximate average tax rate of

Reference: Ref 17-1 (Figure: U.S. Marginal and Average Tax Rates) According to the figure, an individual who earns $150,000 a year has an approximate average tax rate of

Definitions:

Value Basis

The method or the initial cost of an investment used for financial reporting and tax purposes.

Unprocessed Wheat

Raw wheat that has not undergone any cleaning, milling, or processing steps.

Granary

A storage facility for threshed grain or animal feed, typically used by agricultural operations.

Sales Revenues

The income received from selling goods or services over a period of time.

Q10: In the short run, with floating exchange

Q26: The main difference between M1 and M2

Q43: Fiscal policy is most effective when people

Q44: If the Bangladeshi taka depreciates against the

Q64: Lags associated with monetary policy are generally

Q84: What occurs when the value of a

Q92: The purpose of FICA taxes is to

Q101: As a result of an increase in

Q103: Disinflation is engineered through monetary expansions.

Q157: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3375/.jpg" alt=" Suppose in a