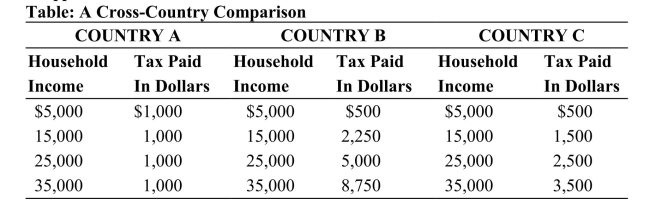

This table shows data on taxes paid by three individuals living in each of three countries: A, B, and C. The tax paid in dollars is based on the marginal tax rates assessed in each of the three countries. Assume that each individual earns an income of exactly $37,000, and there are no deductions or exemptions that need to be applied.  Reference: Ref 17-2 (Table: A Cross-Country Comparison) According to the data in the table, which countries have a progressive tax system?

Reference: Ref 17-2 (Table: A Cross-Country Comparison) According to the data in the table, which countries have a progressive tax system?

Definitions:

Securities

Financial instruments that represent ownership positions in corporations (stock), creditor relationships with governmental bodies or corporations (bonds), or rights to ownership as represented by an option.

Subscriptions Receivable

An amount owed by customers for subscription services or products that have been provided but not yet paid for.

Paid-in Capital

Paid-in capital is the amount of money that a company has received from shareholders in exchange for shares of stock, reflecting the capital that has been invested in the company beyond its par value.

Common Stock Subscribed

A commitment by investors to purchase shares of a company's common stock, where the shares are reserved for the subscribers until payment is made.

Q2: (Figure: Supply-Driven Price Change) Refer to the

Q7: Suppose the central bank targets a low

Q26: When a good has fewer substitutes in

Q73: When the Federal Reserve makes an open

Q74: Time bunching results in I. seasonal cycles

Q74: Which transactions cause the U.S. capital account

Q75: Which of the following individuals is practicing

Q81: The World Bank is the primary force

Q96: If the Federal Reserve responds to a

Q144: Suppose an aggregate demand shock has led