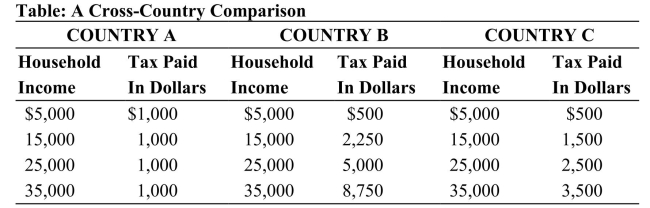

This table shows data on taxes paid by three individuals living in each of three countries: A, B, and C. The tax paid in dollars is based on the marginal tax rates assessed in each of the three countries. Assume that each individual earns an income of exactly $37,000, and there are no deductions or exemptions that need to be applied.  Reference: Ref 17-2 (Table: A Cross-Country Comparison) According to the data in the table, which country has a regressive tax rate system?

Reference: Ref 17-2 (Table: A Cross-Country Comparison) According to the data in the table, which country has a regressive tax rate system?

Definitions:

Accommodation

A concept in psychology referring to the process of adjusting one’s schemas to incorporate new experiences.

Equilibration

The process in developmental psychology where individuals balance assimilation and accommodation to create stable understanding.

Postconventional

A stage in Kohlberg's theory of moral development where individuals base their moral judgments on principles that transcend societal and legal norms, focusing on universal ethical principles.

Unconventional

Not based on or conforming to what is generally done or believed, often characterized by originality or uniqueness.

Q30: Explain the multiplier effect.

Q36: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3375/.jpg" alt=" Reference: Ref 20-3

Q36: The Federal Funds rate is the interest

Q44: (Figure: Aggregate Demand and Fiscal Policy) Figure:

Q47: As the recession continued in early 2009,

Q78: When you shop at Old Navy, you

Q81: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3375/.jpg" alt=" Reference: Ref 4-6

Q84: The largest component of GDP is<br>A) consumption

Q94: The alternative minimum tax is only assessed

Q97: Suppose there is an increase in demand