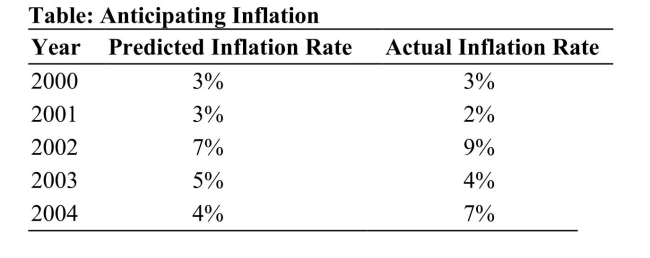

Reference: Ref 12-4 (Table: Anticipating Inflation) Using the inflation data in the table above, assume that all loan contracts had fixed nominal interest rates of 10 percent and matured after one year. In which year did lenders receive exactly the amount of real interest they expected?

Reference: Ref 12-4 (Table: Anticipating Inflation) Using the inflation data in the table above, assume that all loan contracts had fixed nominal interest rates of 10 percent and matured after one year. In which year did lenders receive exactly the amount of real interest they expected?

Definitions:

Gross Margin

The difference between the sales revenue and the cost of goods sold, which shows the profitability of a company’s core activities.

Selling

The process of promoting and transferring ownership of goods or services to customers.

Administrative Expenses

Costs related to the general administration of a business, such as salaries of executive officers, legal and office supplies.

Budgeted Sales

The projected amount of sales, in units or dollars, a company expects to achieve in a specific period.

Q11: Higher labor adjustment costs increase the effect

Q21: Following the great recession in 2010, the

Q44: The fall in housing prices that began

Q47: If the money multiplier is large, then

Q63: Holding everything else constant, an increase in

Q68: Which of the following individuals can be

Q69: Bonds sold by the U.S. government have

Q72: Suppose that consumers begin to believe that

Q101: If the nominal interest rate is 8

Q111: The supply of loanable funds comes from