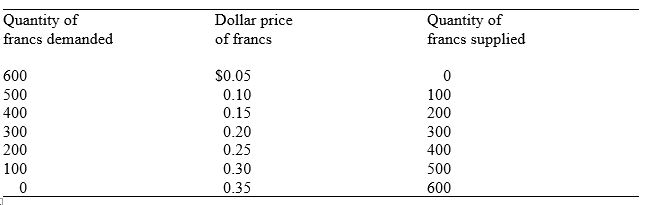

Table 15.1.

The Market for Francs

-Refer to Table 15.1.If monetary authorities fix the exchange rate at $0.10 per franc,there would be a:

Definitions:

Shareholder Leverage

The use of borrowed funds by shareholders to increase their potential returns from an investment.

Operating Leverage

A measure of how revenue growth translates into growth in operating income due to fixed costs in a company's business model.

Tax Rate

The percentage at which an individual or corporation is taxed by the government on their income or profits.

Cost of Debt

The effective rate that a company pays on its current debt, which can be measured in terms of either the before-tax or after-tax cost.

Q3: Concerning exchange rate forecasting,judgmental forecasts are common

Q4: Your company has grown from a national

Q9: Changes in a country's net exports,investment spending,or

Q15: A "key currency" is one that is

Q38: Under managed floating exchange rates,central bank intervention

Q42: Which of the following is not considered

Q47: Referring to Figure 13.4,Canada's foreign-trade multiplier equals

Q47: Which of the following assets makes use

Q92: Refer to Figure 15.2.Demand and supply of

Q162: What is the difference between the crawling