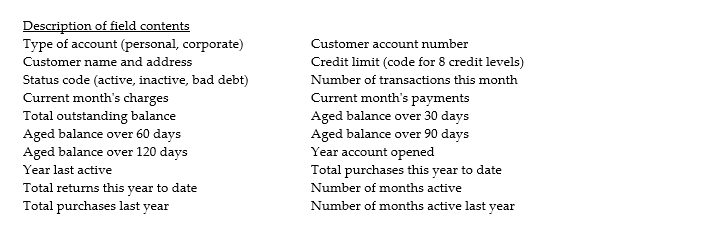

Your audit client is a large retail chain with its own credit card.It has annual sales of about $100 million.On December 31,there were approximately 40 000 open accounts with total receivables of approximately $18.5 million.Very few customer balances exceed $1000.The company's general office maintains the accounts receivable records.The large volume of transactions processed by the company has necessitated extensive segregation of duties and frequent balancing of data during processing.Accordingly,the company's general and system controls are considered to be very good.A complete record of each customer's account is stored on a relational database and includes the following information:

Source transactions are store purchase invoices,payments,and adjustments.Daily,all the orders are received,entered into the computer,and processed against the customer master file.Each account is updated and automatically analyzed to determine whether the transactions just processed have created a condition that should be brought to the attention of the authorization or collection departments.Exception reports are automatically printed and forwarded to these groups.

The company sends monthly statements to customers on a cyclical basis.About 2000 statements are mailed each billing day.As the accounts are updated,the day's transactions are accumulated and added to the starting control figure for each cycle.The new control figures are balanced with the sum of all the individual accounts in the cycle (accumulated as each account is processed).In addition,a detailed transaction and cycle control report is prepared,providing an audit trail in customer account number sequence.

Required:

Describe the audit procedures you would perform in your year-end audit work for this company's accounts receivable.For each audit test,state the relevant audit assertion(s).Be sure to include different types of tests as necessary (e.g.manual or computer-assisted audit techniques),and clearly identify those tests that can be completed using CAATs.

Definitions:

Advertising Costs

The expenses incurred in promoting a product, service, or business, typically through various media channels.

Overapplied Manufacturing Overhead

A situation where the allocated manufacturing overhead costs are more than the actual overhead costs incurred.

T-account

A visual representation of a ledger account that displays its debit and credit sides to explain transactions.

Adjusted Cost of Goods Sold

The cost of goods sold adjusted for changes in inventory levels, often used in managerial accounting to reflect more accurate costs.

Q1: Use of electronic funds transfers (such as

Q11: The following events all occurred after the

Q15: The statement that items on the accounts

Q23: What are the five distinct activities used

Q25: During the process of deciding to accept

Q48: Of these two documents - vendor invoice

Q56: Which of the following controls could help

Q61: Discuss the two most common ways in

Q70: Describe the major risks of error or

Q133: There are two important assumptions that underly