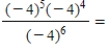

Evaluate the expression.

__________

__________

Definitions:

Fad

A trend or craze that becomes popular for a short period of time before losing its appeal.

Trend

A general direction in which something is developing or changing, often used to describe shifts in societal preferences, technology, or markets.

Conventional Crowd

A collection of people who gather for a structured social event.

Acting Crowd

A collection of people who gather to express anger and direct it outwardly at a specific person, category of people, or event.

Q23: Find the slope and an equation of

Q72: Skeletal remains of the so-called "Pittsburgh Man",

Q92: Find the indefinite integral. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8255/.jpg"

Q101: Let <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8255/.jpg" alt="Let

Q112: Find the point(s) on the graph of

Q119: Evaluate the definite integral. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8255/.jpg"

Q149: Find the second derivative of the function.

Q202: Given that a quantity Q(t) exhibiting exponential

Q220: The population aged 65 years old and

Q297: Find an equation of the tangent line