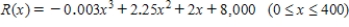

The total annual revenue R of the Miramar Resorts Hotel is related to the amount of money x the hotel spends on advertising its services by the function  where both R and x are measured in thousands of dollars.

where both R and x are measured in thousands of dollars.

Use this function to:

1) Find the interval where the graph of R is concave upward and the interval where the graph of R is concave downward.

2) Find the inflection point of R.

3) Determine if it would it be more beneficial for the hotel to increase its advertising budget slightly when the budget is $240,000 or when it is $260,000.

Definitions:

Economic Downturn

A period of reduced economic activity characterized by declines in spending and investment, often leading to recession.

Diversification

A risk management strategy that mixes a wide variety of investments within a portfolio to reduce exposure to any single asset or risk.

Diversifiable Risk

A type of risk that can be reduced or eliminated from a portfolio through investments in a variety of assets, also known as unsystematic risk.

Arbitrage Pricing Model

A theory for asset pricing that takes into account multiple risk factors and the return of an asset, assuming no arbitrage opportunities.

Q42: Find the derivative of the function.<br> <img

Q52: Find the derivative of the function.<br> <img

Q58: The quantity demanded each month of the

Q96: Bernie invested a sum of money 7

Q113: Find the indicated limit, if it exists.

Q114: Find the indefinite integral.<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8255/.jpg" alt="Find

Q115: Use the four-step process to find the

Q159: The weekly total cost function associated with

Q193: Evaluate the expression.<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8255/.jpg" alt="Evaluate the

Q206: A study conducted by TeleCable estimates that