Multiple Choice

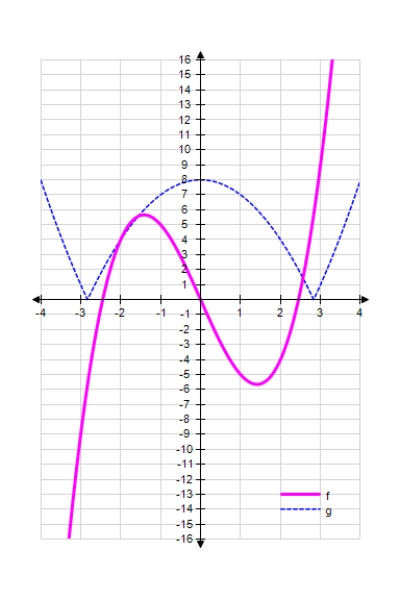

One of the functions below is the derivative function of the other. Identify each of them.

Definitions:

Related Questions

Q72: Find the absolute maximum value and the

Q121: A rectangular box is to have a

Q138: Find the horizontal and vertical asymptotes of

Q172: Find the indefinite integral.<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8255/.jpg" alt="Find

Q187: How long will it take $4,000 to

Q188: Given that a quantity Q(t) is described

Q190: Find the derivative of the function.

Q201: Wood deposits recovered from an archeological site

Q243: Find the first and second derivatives of

Q273: Find the derivative of the function by