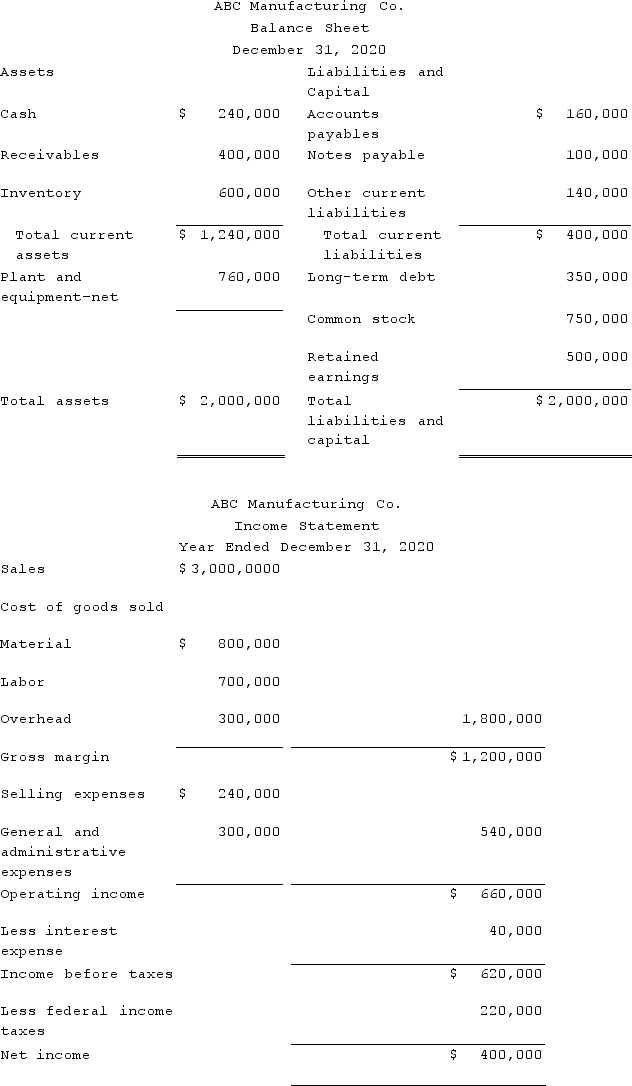

Analytical procedures are evaluations of financial information made by a study of plausible relationships among financial and nonfinancial data. Understanding and evaluating such relationships are essential to the audit process.The following financial statements were prepared by ABC Manufacturing Co. for the year ended December 31, 2020. Also presented are various financial statement ratios for Holiday as calculated from the prior year's financial statements. Sales represent net credit sales. The total assets and the receivables and inventory balances at December 31, 2020, were the same as at December 31, 2019.

Required:Items 1 through 9 below represent financial ratios that the auditor calculated during the prior year's audit. For each ratio, calculate the current year's ratio from the financial statements presented above.

Required:Items 1 through 9 below represent financial ratios that the auditor calculated during the prior year's audit. For each ratio, calculate the current year's ratio from the financial statements presented above.

Definitions:

Escalation Of Commitment

A decision-making process where individuals or groups continue to invest in a decision despite new evidence suggesting it might be wrong.

Sunk Costs

Expenses that have already been incurred and cannot be recovered, which should not affect future decision-making but often do.

External Review

An evaluation or assessment conducted by individuals or entities outside of an organization to ensure objectivity and impartiality, often focusing on processes, products, or financial health.

Framing Bias

A cognitive bias where people react differently to a particular choice depending on how it is presented, such as a loss or gain.

Q11: Which of the following factors should an

Q21: Auditors count investment securities held by the

Q29: An auditor selected an invoice for a

Q33: Which of the following best reflects

Q43: In the revenue and collection cycle, the

Q53: The overall attitude and awareness of an

Q58: When an account receivable is considered uncollectible,

Q67: Define a scope limitation and distinguish between

Q74: In which of the following circumstances would

Q103: When auditors qualify their opinion on the