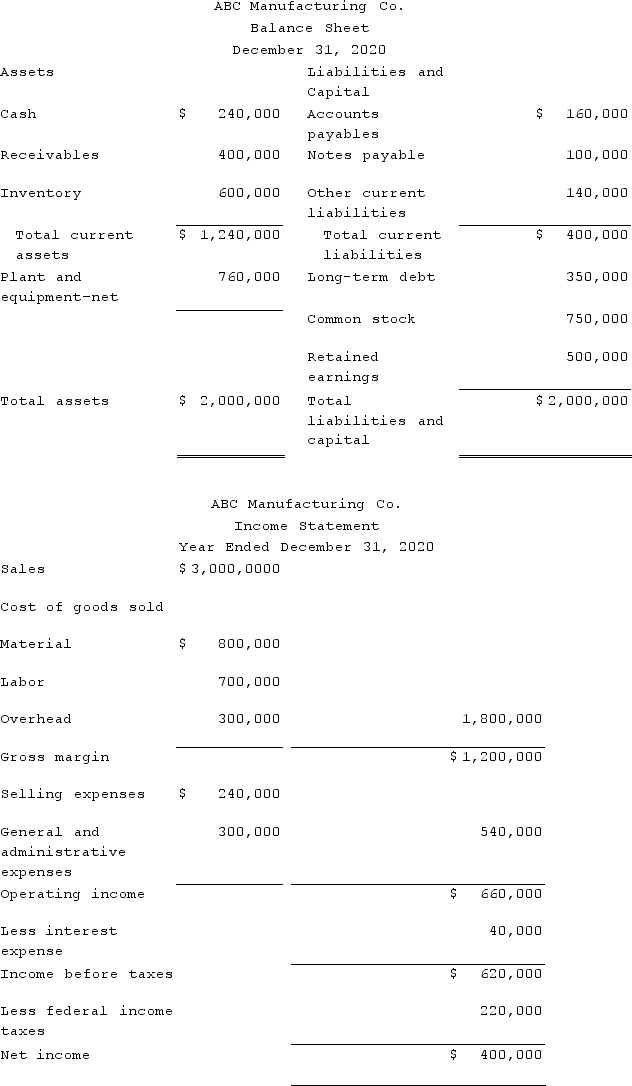

Analytical procedures are evaluations of financial information made by a study of plausible relationships among financial and nonfinancial data. Understanding and evaluating such relationships are essential to the audit process.The following financial statements were prepared by ABC Manufacturing Co. for the year ended December 31, 2020. Also presented are various financial statement ratios for Holiday as calculated from the prior year's financial statements. Sales represent net credit sales. The total assets and the receivables and inventory balances at December 31, 2020, were the same as at December 31, 2019.

Required:Items 1 through 9 below represent financial ratios that the auditor calculated during the prior year's audit. For each ratio, calculate the current year's ratio from the financial statements presented above.

Required:Items 1 through 9 below represent financial ratios that the auditor calculated during the prior year's audit. For each ratio, calculate the current year's ratio from the financial statements presented above.

Definitions:

Electrocardiogram

A test that records the electrical activity of the heart to detect heart problems and monitor the heart's status.

Room Preparation

The process of arranging and setting up a room for a specific purpose or event, which can include cleaning, organizing, and equipping the space with necessary items.

ECG Paper

Specialized grid paper used in electrocardiography to record the electrical activity of the heart over a period of time.

Depolarization

The loss of polarity, or opposite charges inside and outside; the electrical impulse that initiates a chain reaction resulting in contraction.

Q4: The initial development of auditing standards was

Q20: Which of the following is a definition

Q21: Which of the following best describes auditors'

Q22: The Sarbanes-Oxley Act of 2002 requires that

Q27: Which of the following would not likely

Q28: The appropriate separation of duties does not

Q40: The mail which includes payments should be

Q74: A production order usually includes a _.

Q88: Which of the following controls is designed

Q160: When there has been a change in