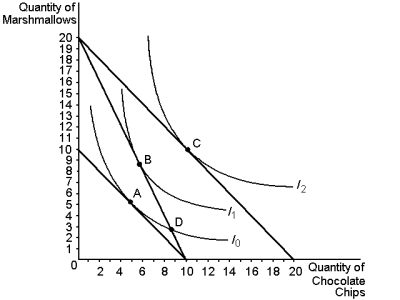

Graph 22-8

-Refer to Graph 22-8. Assume that the consumer depicted in the graph has an income of $80. If the price of marshmallows is $4, the optimising consumer would choose to purchase:

Definitions:

Delta

In finance, delta represents the rate of change of the theoretical option price with respect to changes in the underlying asset's price.

Call Option

A financial contract giving the buyer the right, but not the obligation, to buy a stock, bond, commodity, or other asset at a specified price within a specified time.

Black-Scholes

A mathematical model used to estimate the theoretical price of European put and call options, considering factors such as risk-free rate, volatility, and time.

Instantaneous Risk-free Rate

The theoretical rate of return of an investment with no risk of financial loss, typically considered as a very short-term government bond yield.

Q4: An important benefit of private ownership of

Q25: Refer to Graph 18-1. If a firm

Q31: A rock is thrown straight up and

Q32: Information asymmetries do not impede the efficient

Q43: A car traveling at 4.0 m/s has

Q48: In Australia, the share of pre-tax income

Q52: Using the following unit conversions: 1.00 fluid

Q57: The veil of ignorance refers to:<br>A) the

Q67: The flow from capital resources is compensated

Q74: Some business practices that appear to reduce