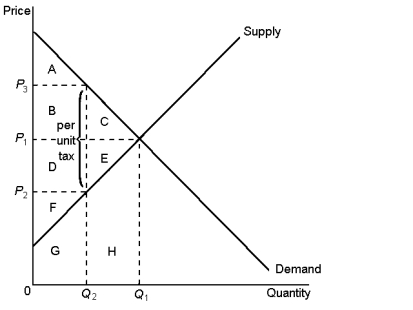

Graph 8-1

-According to Graph 8-1, the tax caused a reduction in consumer surplus, it is represented by area:

Definitions:

Adam Smith

An 18th-century Scottish economist and philosopher, best known for his theories on free market economies and the concept of 'invisible hand' guiding supply and demand.

Government Duties

Financial charges imposed by the government on goods, services, or activities, primarily focused on imports and exports.

Marginal Rates

Rates that apply to the next dollar of taxable income; often used in the context of income tax, where different income levels are taxed at different rates.

Taxable Income

The portion of an individual's or corporation's income that is subject to taxes by government authorities.

Q2: Which of the following statements is true?<br>A)

Q17: A Pigovian tax:<br>A) allocates pollution to those

Q18: Peter owns a sawmill and produces timber

Q29: The indirect effects from taxation would include:<br>A)

Q42: An import quota increases domestic producer surplus

Q45: If the price of forest-products rises, the

Q54: Suppose the government imposes a binding price

Q65: For the purpose of cost-benefit analysis, the

Q67: In Graph 9-8, consumer surplus after the

Q74: According to Graph 8-1, consumer surplus before