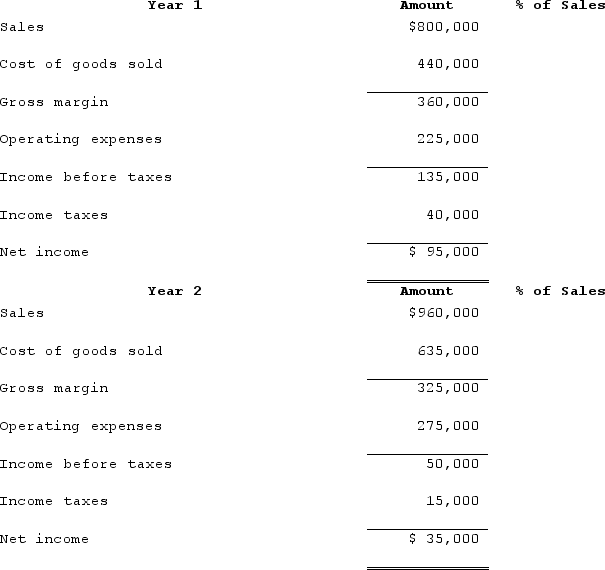

Montana Company reported the following operating results for Year 1 and Year 2:

Required:

Required:

Express each income statement component for each year as a percentage of sales. Round your answer to one decimal place (i.e., 22.5%).

Definitions:

Cost Plus Contract

A type of contract where the buyer agrees to pay the seller all project costs, plus an additional amount or percentage as profit.

Allowable Expenses

Costs that are recognized under the provisions of a contract or agreement as reimbursable or claimable.

Contractor's Fee

The payment made to a contractor for their services, typically a percentage of the total cost of a construction project.

Cost Reimbursable Contract

A type of contract where the client pays the contractor for all legitimate actual costs incurred for the project plus a fee representing the contractor’s profit.

Q12: Gilligan Corporation was established on February 15,

Q29: Compute the amount of cash a company

Q50: Which of the following statements regarding the

Q66: Which type of stock, common or preferred,

Q67: John's share of partnership loss was $60,000.

Q69: What type of account is Accumulated Depreciation?

Q70: A partner in a limited liability partnership

Q71: Mr. Olsen has a marginal tax rate

Q126: All corporations are subject to extensive government

Q141: Indicate how each event affects the horizontal