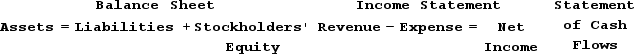

Indicate how each event affects the horizontal financial statements model. Use the following letters to record your answer in the box shown below. If an event increases one account and decreases another account equally within the same element, record I/D. If an event has no impact on the element, record NA. Use only one letter for each element. You do not need to enter amounts.

Increase = IDecrease = D No Affected = NA The stock of Atlantic Oil Company was trading at $14 per share on March 27 when the company announced that it had recently discovered a large oil reserve. The stock price immediately went up to $28 per share. The company had 10,000,000 shares outstanding. Indicate the effects of this discovery on Atlantic's financial statements.

Definitions:

Treasury Bonds

Long-term, fixed-interest U.S. government debt securities with a maturity of more than ten years.

Interest Rate Futures

Financial derivatives contracts that obligate the buyer to purchase an asset (like Treasury bills or bonds) at a future date at a predetermined interest rate.

Spot Market

A financial market in which commodities or financial instruments are traded for immediate delivery.

Treasury Notes Futures

Financial contracts obligating the buyer to purchase and the seller to sell U.S. Treasury notes at a predetermined future date and price.

Q7: Indicate how each event affects the horizontal

Q19: The accounting profession assumes that financial statement

Q32: Earnings before interest and taxes divided by

Q67: John's share of partnership loss was $60,000.

Q84: William is a member of an LLC.

Q84: Which of the following statements regarding the

Q90: What is the meaning of "par value"

Q144: Which of the following statements about the

Q160: The Dennis Company reported net income of

Q176: In December Year 1, Lucas Corporation sold