Chandler Company declared and paid a cash dividend. Which of the following choices accurately reflects how this event would affect the company's financial statements?

Definitions:

Strategic Alliances

Partnerships between two or more companies to pursue a set of agreed upon objectives while remaining independent organizations.

Intellectual Property

Legal rights related to creations of the mind, such as inventions, literary and artistic works, symbols, names, and images.

Organizational Success

The achievement of the goals and objectives set by an organization, typically measured by various performance indicators.

Total Cost Of Ownership

An accounting framework that considers all the direct and indirect costs associated with acquiring and using a product or system over its entire life cycle.

Q16: If a business is formed as an

Q50: Zebra Company purchased a van for $8,000

Q62: Angel Corporation's current-year regular tax liability is

Q76: Borough, Inc. is entitled to a rehabilitation

Q91: Westside, Inc. owns 15% of Innsbrook's common

Q94: On January 1, Year 1, Daniels Company

Q97: Drake Partnership earned a net profit of

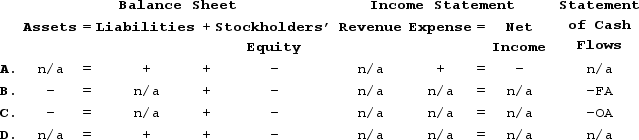

Q105: Indicate how each event affects the horizontal

Q127: A substantial amount spent to improve the

Q207: When bonds are issued at a premium,