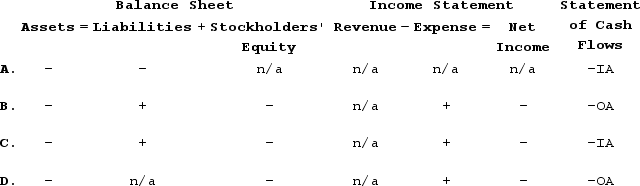

Bruce Company experienced an accounting event that that increased interest expense, decreased the discount on bonds payable, and decreased cash. Which of the following choices accurately reflects how this event would affect Bruce's financial statements?

Definitions:

FMV

Fair Market Value, the price at which property would change hands between a willing buyer and a willing seller, neither being under compulsion to buy or sell.

Distribution

The payment of dividends or assets to shareholders or partners from a corporation, partnership, or another type of entity.

Partnership

A type of business structure where two or more people share ownership, as well as the responsibility for managing the business and the income or losses it generates.

Ordinary Income

Income earned through salaries, wages, commissions, and interest, subject to standard tax rates.

Q3: Jing Company was started on January 1,

Q10: The term "double taxation" refers to which

Q27: When a credit card sale is recorded,

Q37: If a company uses the effective interest

Q43: Sable Company is seeking a short-term loan

Q59: The following pre-closing accounts and balances

Q122: Explain how the gain or loss is

Q126: North Woods Company has a line

Q154: Weller Company issued bonds with a face

Q158: Davis Corporation borrowed $50,000 on January 1,