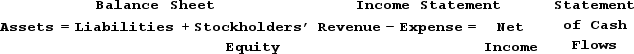

Indicate how each event affects the horizontal financial statements model. Use the following letters to record your answer in the box shown below. If an event increases one account and decreases another account equally within the same element, record I/D. If an event has no impact on the element, record NA. You do not need to enter amounts.Increase = I Decrease = D Not Affected = NAOn April 1, Year 2, Jenkins Company repaid a $20,000, one-year, 6% note and interest to Community Bank. Interest on the note had been accrued on December 31, Year 1. Record the financial statement effects for Jenkins Company in Year 2.

Definitions:

Elastic Supply

A situation where the quantity supplied of a good or service changes significantly in response to a change in price.

Regressive Tax

A tax system where the tax rate decreases as the taxable amount increases, placing a higher burden proportionally on lower-income earners.

Tax Schedules

Detailed tables or lists provided by tax authorities that outline the tax rates applicable to various levels of taxable income.

Taxable Income

The amount of an individual’s or corporation's income used to calculate how much tax they owe to the government, after deductions and exemptions.

Q9: What is meant by the net realizable

Q36: Below are the income statements of

Q48: Grove Corporation had sales of $3,000,000, cost

Q56: When do the effects of product warranties

Q76: Gains and losses are reported as non-operating

Q78: Paying cash to settle a salaries payable

Q92: Indicate whether each of the following statements

Q99: The Fortune Company reported the following

Q110: Indicate how each event affects the horizontal

Q163: The Poole Company reported the following