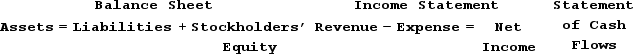

Indicate how each event affects the horizontal financial statements model. Use the following letters to record your answer in the box shown below. If an event increases one account and decreases another account equally within the same element, record I/D. If an event has no impact on the element, record NA. You do not need to enter amounts.Increase = I Decrease = D Not Affected = NAOn December 31, Year 1, Ravenswood Company made an annual payment on a long-term installment note payable. Show how this annual payment affected Ravenswood's financial statements.

Definitions:

Equipment

Tangible assets used in operations, such as machinery or computers, that have a useful life beyond one accounting period.

MACRS

Modified Accelerated Cost Recovery System, a method of depreciation in the United States that allows businesses to recover investments in certain property through tax deductions over a specified life.

Scrap Value

The estimated value that an asset will realize upon its sale at the end of its useful life; often used in depreciation calculations.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life, reflecting wear and tear, obsolescence, or other declines in value.

Q12: Gomez Company collected $21,300 on September 1,

Q16: For Year 1, the Sacramento Corporation had

Q24: For each of the following transactions, indicate

Q31: Knoell Company paid its sales employees $15,000

Q34: Which of the following is a disadvantage

Q63: The Maryland Corporation was started on January

Q67: On January 1, Year 1, the Vanguard

Q88: What is the effect of the recognition

Q98: What is the amount of net income

Q164: Wiggins Company issued a $66,000, 8% note