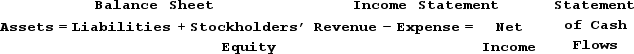

Indicate how each event affects the horizontal financial statements model. Use the following letters to record your answer in the box shown below. If an event increases one account and decreases another account equally within the same element, record I/D. If an event has no impact on the element, record NA. You do not need to enter amounts.Increase = IDecrease = DNot Affected = NAThe Benitez Company purchased an asset for $50,000 on January 1, Year 1. The asset had a zero salvage value and an 8-year estimated useful life. On January 1, Year 3, the company spent $2,400 cash on routine repairs and maintenance. What effect will the Year 3 expenditure have on the company's financial statements?

Definitions:

T-test

A statistical test used to compare the means of two groups and determine if there are statistically significant differences between them.

Null Hypothesis

A statement used in hypothesis testing that posits there is no statistical significance in a set of given observations, aiming to be either rejected or not rejected.

Alpha

In hypothesis testing, the alpha value denotes the threshold of significance, where typical levels are 0.05 (5%) or 0.01 (1%), used to determine if the null hypothesis can be rejected.

Q4: Indicate whether each of the following statements

Q11: Discuss some of the information items normally

Q20: Indicate how each event affects the elements

Q20: In a company's annual report, the reader

Q28: List three measures that a business can

Q28: If Kettler Company loans $24,000 to Beam

Q30: Rexrode Company's bank statement at January 31

Q60: Indicate how each event affects the elements

Q141: Which of the following is an asset

Q181: Which of the following is <b>false</b> regarding