The following information is for Poole Company for the current year:

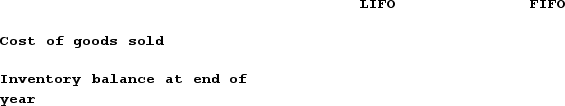

Required:Assuming that Poole uses the LIFO cost flow method, determine how much product cost would be allocated to Cost of Goods Sold, and how much to Merchandise Inventory at the end of the year. Show all calculations.Assuming that Poole uses the FIFO cost flow method, determine how much product cost would be allocated to Cost of Goods sold, and how much to Merchandise Inventory at the end of the year. Show all calculations.Compare your results from parts a and b. Do LIFO and FIFO give the same results for inventory turnover? Which is higher, and why?

Definitions:

Standard Hourly Rate

The predetermined cost per hour for labor, used in budgeting and costing to assign labor costs to products and services.

Standard Quantity

The budgeted or pre-determined amount of material or input expected to be used during a manufacturing process.

Standard Hours Allowed

The time that should have been taken to complete the period’s output. It is computed by multiplying the actual number of units produced by the standard hours per unit.

Material Price Variances

The difference between the expected cost of materials and the actual cost incurred, useful in budgeting and cost management.

Q20: What does a company's statement of cash

Q33: A classified balance sheet is one that

Q48: On what date do dividends become a

Q64: Abbott Company opened for business on January

Q111: Jacobs Company issued bonds with $172,000 face

Q118: Victor Company issued bonds with a $250,000

Q139: Indicate how each event affects the horizontal

Q139: The Mason-Dixon partnership was formed on January

Q156: An impairment of an intangible asset decreases

Q165: Indicate how this event affects the accounting