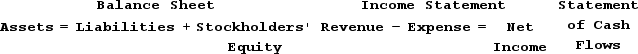

Indicate how each event affects the elements of financial statements. Use the following letters to record your answer in the box shown below each element. If an event increases one account and decreases another account equally within the same element, record I/D. If an event has no impact on the element, record NA. You do not need to enter amounts. Enter only one letter for each element.Increase = I Decrease = D Not Affected = NAAt June 30, when Heath Company was preparing the bank reconciliation, the employee preparing the reconciliation found that the company had outstanding checks in the amount of $2,650.

Definitions:

CCA Class

A category under the Canadian tax system that determines the depreciation rate for tax purposes on capital assets.

Net Advantage

The benefit or gain that results from a specific course of action, minus any associated costs.

Resale Value

The estimated value for which an asset can be sold in the marketplace after some period of use.

Depreciation Tax Shield

A reduction in taxable income for firms, achieved through claiming depreciation expenses, thereby lowering the tax liability.

Q19: The following information is for Benitez

Q33: A classified balance sheet is one that

Q50: How are interest rates normally set for

Q64: Abbott Company opened for business on January

Q72: Mayberry Company paid $30,000 cash to purchase

Q90: What effect does the recording of revenue

Q101: Packard Company engaged in the following transactions

Q109: Bledsoe Company received $17,000 cash from the

Q125: Which of the following is an asset

Q188: Peak Enterprises issued bonds with a face