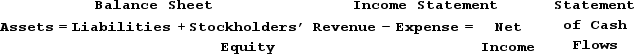

Indicate how each event affects the elements of financial statements. Use the following letters to record your answer in the box shown below each element. If an event increases one account and decreases another account equally within the same element (such as an asset exchange event), record I/D. If an event has no impact on the element, record NA. You do not need to enter amounts. Assume that Whetzel Company uses a perpetual inventory system.Increase = I Decrease = D Not Affected = NAOn April 1, Year 1, Wetzel Co. paid a supplier, Jacobs Company, the amount owed on account related to a purchase of inventory on account with terms of 2/10, net/30. The inventory was purchased on March 1, Year 1.

Definitions:

Marginal Tax Rate

The rate of tax applied to the last dollar of income, used to determine how much tax will be owed on an additional dollar of income.

Operating Cash Flow

An indicator of the cash produced through a company's regular business activities.

Interest Expense

The financial charge an organization incurs over a period for taking out loans.

Operating Cash Flow

This measures the cash generated by a company's normal business operations, indicating whether it is capable of maintaining and growing its operations.

Q4: Garrison Company acquired $23,000 by issuing common

Q5: What type of account is Allowance for

Q34: Explain the meaning of "internal control."

Q52: The following events apply to Bowman's Cleaning

Q81: On January 1, Year 1, Milton Manufacturing

Q121: Morrison Company issued $200,000 of 10-year, 8%

Q137: In a market, a company that manufactures

Q153: Indicate how each event affects the elements

Q163: At the end of Year 1, Durango

Q182: Lexington Company engaged in the following transactions