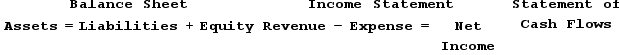

Which of the following shows how a payment made to settle an accrued expense, such as the salaries payable, will affect a company's financial statements?

A.

B.

C.

D.

Definitions:

Subscriptions Receivable

An amount owed by customers for subscription services or products that have been provided but not yet paid for.

Paid-in Capital

Paid-in capital is the amount of money that a company has received from shareholders in exchange for shares of stock, reflecting the capital that has been invested in the company beyond its par value.

Common Stock Subscribed

A commitment by investors to purchase shares of a company's common stock, where the shares are reserved for the subscribers until payment is made.

Dividends in Arrears

Dividends on preferred shares that have not been paid in the scheduled time, accruing until they are paid out.

Q9: Weller Company issued bonds with a face

Q52: On January 1, Year 1, Friedman Company

Q57: Each of the following requirements is independent

Q61: Indicate how each event affects the horizontal

Q64: Which of the following accounts are permanent?<br>A)

Q76: Which of the following cash transactions results

Q110: The term "accrual" describes an earnings event

Q135: Indicate whether each of the following statements

Q160: The following transactions apply to Wilson Fitness

Q205: On January 1, Year 1, Mayberry Company