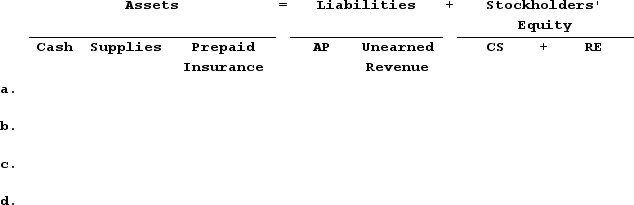

Using the form below, record each of the following transactions for Mayer Corporation during the year ending December 31, Year 1. (Note: There is no need to provide appropriate account titles for the Retained Earnings amounts in the last column of the table.)November 1: Received cash from clients for services to be performed over the next six months, $12,000November 1: Paid $1,200 for a 12-month insurance policyDecember 31: Recorded expiration of two months of the insuranceDecember 31: Earned $4,000 of the amount received from clients in November

Definitions:

Schedule Of Accounts Receivable

A list of the customers, in alphabetical order, that have an outstanding balance in the accounts receivable subsidiary ledger. This total should be equal to the balance of the Accounts Receivable controlling account in the general ledger at the end of the month.

Control Account

A summary account in the general ledger that consolidates and reflects the total of transactions recorded in subsidiary ledgers.

Customers' Names

Identifying information for individuals or entities that purchase goods or services from a business.

Subsidiary Ledger

A detailed ledger that contains the accounts of specific areas of business, supporting data for accounts in the general ledger.

Q28: If Kettler Company loans $24,000 to Beam

Q66: Indicate how each event affects the horizontal

Q67: Jack's Snow Removal Company received a cash

Q102: The year-end financial statements of Calloway Company

Q113: White Company budgeted fixed overhead costs of

Q118: When is revenue recognized under accrual accounting?

Q128: Nelson Company experienced the following transactions during

Q139: The sales volume variance is the difference

Q140: The effects of transactions occurring during Year

Q149: Indicate how each event affects the horizontal