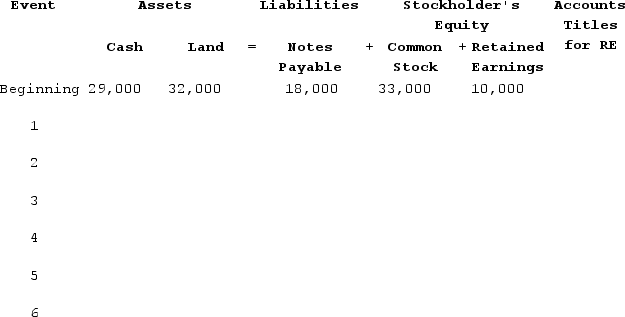

At the beginning of Year 2, Grace Company's accounting records had the general ledger accounts and balances shown in the table below. During Year 2, the following transactions occurred:Received $95,000 cash for providing services to customersPaid salaries expense, $50,000Purchased land for $12,000 cashPaid $4,000 on note payablePaid operating expenses, $22,000Paid cash dividend, $2,500Required:Record the transactions in the appropriate general ledger accounts. Record the amounts of revenue, expense, and dividends in the retained earnings column. Enter 0 for items not affected. Provide appropriate titles for these accounts in the last column of the table.

Definitions:

Return on Total Assets

This metric evaluates a company's efficiency in using its assets to generate profit, calculated by dividing net income by total assets.

Interest Expense

The cost incurred by an entity for borrowed funds, typically reported on the income statement.

Income Tax Rate

The percentage at which an individual or corporation is taxed on their income.

Return on Equity

A measure of the profitability of a business in relation to the equity, indicating how effectively equity is used to generate profits.

Q5: The year-end financial statements of Calloway Company

Q32: The following transactions apply to Sam's

Q64: Huang Company reported the following information

Q65: Which one of the following statements best

Q101: The following pre-closing accounts and balances

Q102: What is the reinvestment assumption, and how

Q106: How will accounts receivable appear on the

Q108: Packard Company engaged in the following transactions

Q114: Matt needs to compute the present value

Q154: The selling and administrative expense budget is