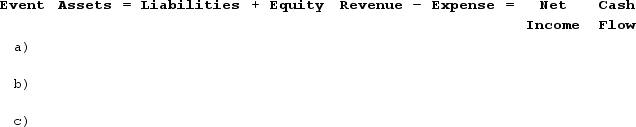

During Year 1, Pace Company issued common stock to stockholders for $12,000, purchased land for $3,200 cash, and paid cash dividends of $1,000 to the company's stockholders. Enter each of these three events into the horizontal financial statements model, below. Indicate dollar amounts of increases and decreases. For cash flows, show whether they are operating activities (OA), investing activities (IA), or financing activities (FA). Enter 0 if there would be no entry in a column.

Definitions:

Diversification

Spreading a portfolio over many investments to avoid excessive exposure to any one source of risk.

Portfolio

A collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, including mutual funds and ETFs.

Unique Risk

Nonmarket or firm-specific risk factors that can be eliminated by diversification. Also called firm-specific risk, nonsystematic risk, or diversifiable risk.

Diversification

Diversification is an investment strategy that aims to reduce risk by allocating investments among various financial instruments, industries, geographic locations, or other categories.

Q1: During December Year 1, Crowe Company

Q9: Payne Company reported the following information

Q14: One of your friends is preparing to

Q18: Flexible budget amounts for variable costs and

Q23: During Year 1, Pace Company issued common

Q34: On June 14, Year 1, Sure-Fit Shoe

Q54: Curtis Company uses the FIFO cost

Q58: Which of the following is <b>not </b>an

Q150: Vanessa Grant is responsible for controlling expenses,

Q161: Which of the following statements regarding a