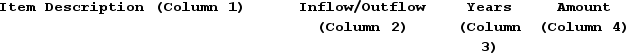

Janelle Bates has just inherited $250,000 from her uncle's estate. She is considering opening a small sewing and fabric shop. She would need to purchase inventory costing $50,000. Janelle plans to rent a shop in a local shopping center for $12,000 per year. Fixtures, display equipment, and furniture will cost $18,000 and will be depreciated $3,000 per year for 5 years to its expected salvage value of $3,000. Operating costs will amount to $25,000 per year. Janelle estimates her revenues from sales and sewing services will total $65,000. Because Janelle believes she can earn a 10% return by investing in mutual funds, she does not want to start the business unless she can earn at least this rate. Ignore income taxes.(PV of $1and PVA of $1) (Use appropriate factor(s) from the tables provided.)Required:Prepare a schedule of expected cash flows for the proposed investment by completing the table provided below. In Column 1 enter a brief description of the cash flow. In Column 2 indicate whether the cash flow is an inflow (I) or an outflow (O). In Column 3 enter the years in which the cash flow will occur. For example, if the cash flow occurs immediately enter a 0. If the cash flow occurs each year, enter 1 to 5, etc. In Column 4 enter the cash flow amount.

Definitions:

Measurement Of Learning

involves the assessment and quantification of the knowledge, skills, attitudes, and behaviors acquired through educational processes.

Evaluation

The systematic process of assessing or judging the value, performance, or significance of something.

Measurement Of Learning

The process of assessing the extent to which educational objectives or outcomes have been achieved by learners.

Organizational Development

This encompasses the study, theoretical exploration, and practical efforts aimed at increasing the ability of people to effectuate significant organizational modifications and boost performance.

Q6: Consider the following independent scenarios:At January 1,

Q19: Tableware Unlimited Company plans to sell

Q21: Retained Earnings at the beginning and ending

Q37: Classifying costs into one of four hierarchical

Q52: ABC Company earned $2,000 cash for providing

Q85: Canton Company estimates sales of 12,000 units

Q86: Joan Osborne is evaluating a potential capital

Q105: Who are the three distinct types of

Q135: Which of the following events would not

Q150: Vanessa Grant is responsible for controlling expenses,