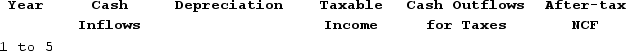

Columbus Company is considering a project that requires an initial investment of $400,000. Its incremental cash flows are expected to be $150,000 per year for 5 years. The project would be depreciated on a straight-line basis over 5 years with no expected salvage value. The company has a stated policy that all projects must return their required investment dollars within the first 75% of the project's life. The company is subject to a 40% income tax rate, and its cost of capital is 10%. (PV of $1and PVA of $1) (Use appropriate factor(s) from the tables provided.)Required:Compute the project's after-tax net cash flows (NCF) by completing the following table:

Definitions:

Liver

A vital organ found in vertebrates that performs numerous functions, including detoxification, protein synthesis, and the production of biochemicals necessary for digestion.

Gallbladder

A small, pear-shaped organ located beneath the liver, storing and concentrating bile produced by the liver before releasing it into the small intestine.

Glycogen

A multi-branched polysaccharide of glucose that serves as a form of energy storage in animals, fungi, and bacteria.

Appendix

A small, tube-like sac attached to the large intestine, its function is not entirely understood, but it is known to play a role in gut immunity.

Q4: Select the incorrect statement concerning the application

Q5: Which of the following statements is incorrect?<br>A)

Q28: The following transactions apply to Kellogg Company.Issued

Q89: Which of the following costs is an

Q105: Maggie Stern started a consulting business, Stern

Q109: Borrowing money from the bank is an

Q110: The following standard cost card is

Q123: The master budget details:<br>A) Long-term objectives.<br>B) Intermediate

Q130: Levin Company is considering two new

Q145: Virginia Jackson is opening Jackson Realty