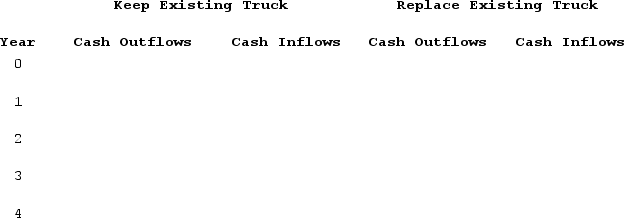

Bruce Company is considering replacing one of its delivery trucks. The truck in question was purchased two years ago at a cost of $41,000. At the time of purchase the truck was expected to have a $5,000 salvage value at the end of its six-year life. Given the use of straight-line depreciation, the truck has a current book value of $29,000. If sold today, the company could get $22,000 for the truck. It costs $20,000 per year to operate the existing truck. The new truck would cost $46,000 and would cost only $14,000 per year to operate. The new truck would be depreciated on a straight-line basis over its four-year useful life to its expected salvage value of $10,000. The company's required rate of return is 14%. Ignore income taxes. (PV of $1and PVA of $1) (Use appropriate factor(s) from the tables provided.)Required:Identify the cash flows for each alternative by completing the following table:

Definitions:

Quantities

The amounts or numbers of a material or item available or required.

Various Prices

Describes a market scenario where identical or similar goods or services are sold at different price points.

Demand Schedule

A table or graph showing the quantity of a good that consumers are willing to purchase at each possible price.

Determinants of Demand

Factors such as price, income, preferences, and tastes that affect the buyers' willingness and ability to purchase goods and services.

Q61: Jason is trying to decide which

Q80: The inventory purchases budget is based on

Q91: Kelly Company experienced the following events during

Q102: Suboptimization refers to actions taken by a

Q103: The following standard cost card is

Q112: Wing Company paid $5,000 cash to

Q112: Indicate whether each of the following statements

Q129: On January 1, Year 2, Chavez

Q138: Indicate whether each of the following statements

Q155: Financial accounting standards are known collectively as