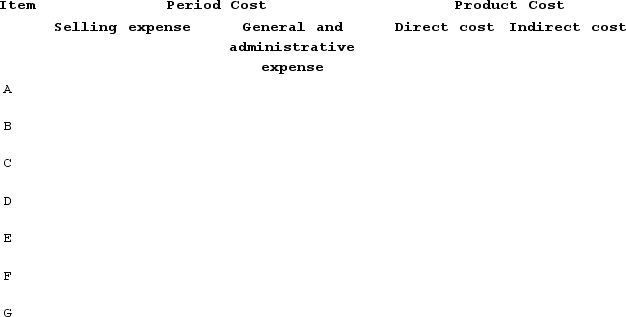

Classify each of the following costs for Harrison Company as a selling or general and administrative period cost or as a direct or indirect product cost by entering the dollar amount(s) in the appropriate column(s):Paid $75,000 in wages for employees who assemble the company's products.Paid sales commissions of $58,000.Paid $38,000 in salaries for factory supervisors.Paid $88,000 in salaries for executives (president and vice presidents).Recorded depreciation cost of $25,000. $13,000 was depreciation on factory equipment and $12,000 was depreciation on the company headquarters building.Paid $4,000 for various supplies that it used in the factory (oil and materials used in machine maintenance).Used $10,000 in prepaid corporate liability insurance.

Definitions:

Split-off Point

The stage in a process at which various products become separately identifiable and their costs can be separately assigned.

Joint Products

Two or more products that are produced from a common input.

Special Order

A one-time order that is not considered part of the company’s normal ongoing business.

Opportunity Costs

The benefits a person or business foregoes by choosing one alternative over another.

Q1: List and describe three different plating techniques

Q2: A long fermentation at room temperature helps

Q4: Which of the following desserts would NOT

Q8: Which of the following does NOT describe

Q10: When working with nougatine, all work surfaces,

Q12: Shake a custard pie gently to see

Q20: _ _is a type of delicate, unleavened

Q27: In forensic psychology, a method of predicting

Q29: Sheddon Industries produces two products. The

Q163: The primary advantage of establishing cost pools