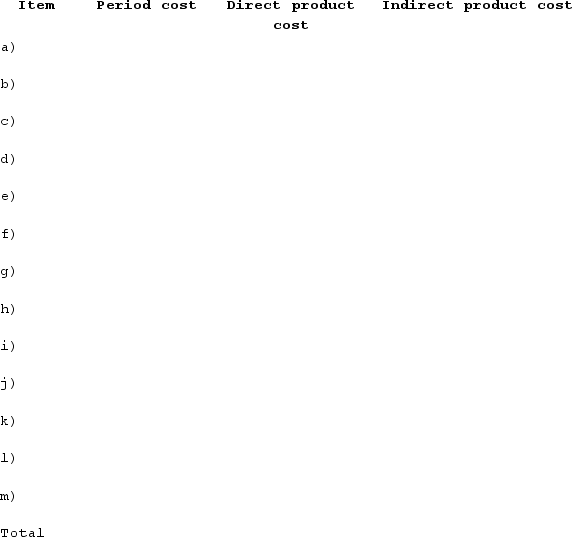

The Giga Company Produces Tablet Computers Required:Classify Each of the Company's Costs as a Period Cost

The Giga Company produces tablet computers. The following information is provided:

Required:Classify each of the company's costs as a period cost (general, selling, and administrative cost) or as a direct or indirect product cost. Enter the dollar amount of the cost in the appropriate column. After entering all amounts, calculate the total general, selling, and administrative cost, the total direct product cost, and the total indirect product cost.

Definitions:

Therapeutic Management

The systematic and strategic approach to treating a medical condition or disease to improve patient outcomes.

Impetigo Contagiosa

A highly contagious skin infection caused by bacteria, leading to red sores that can rupture and crust over.

Topical Corticosteroids

Anti-inflammatory medications applied to the skin to treat a variety of conditions, including eczema and psoriasis.

Wood Lamp

A diagnostic tool that uses ultraviolet light to examine the skin for bacterial or fungal infections and other skin conditions.

Q2: The benefits of a just-in-time system would

Q3: Which of the following tools is used

Q8: USDA standards for ice cream require that

Q11: An ovo-lacto vegetarian consumes a plant-based diet,

Q17: Why doesn't sweet tart dough (which contains

Q40: What name is given to statistical prediction

Q50: Which of the following costs would be

Q64: Distinguishing between product and period costs is

Q113: Alleghany Community College operates four departments.

Q201: Pets 'n Pals is attempting to determine