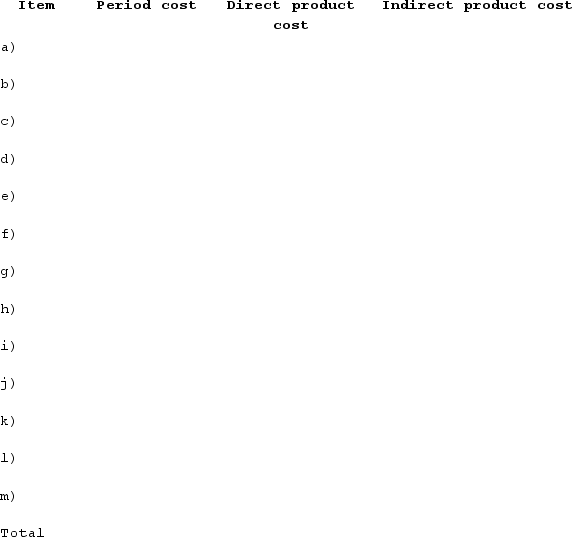

The Giga Company Produces Tablet Computers Required:Classify Each of the Company's Costs as a Period Cost

The Giga Company produces tablet computers. The following information is provided:

Required:Classify each of the company's costs as a period cost (general, selling, and administrative cost) or as a direct or indirect product cost. Enter the dollar amount of the cost in the appropriate column. After entering all amounts, calculate the total general, selling, and administrative cost, the total direct product cost, and the total indirect product cost.

Definitions:

Brand Name Drugs

Medications sold under a proprietary, trademarked name, as opposed to their generic equivalents.

Medigap

Private insurance to supplement Medicare benefits for payment of the deductible, co-payment, and coinsurance.

Medicare Benefits

Government-funded health insurance benefits available to eligible individuals, typically those who are 65 or older, or those with certain disabilities.

Coinsurance

A percentage that a patient is responsible for paying for each service after the deductible has been met.

Q1: Discuss the four methods for tempering couverture

Q3: Explain why butter should be softened before

Q12: _icing has a thin crust and a

Q13: One challenge for psychologists serving as expert

Q15: The most common form of sugar in

Q96: The Juarez Corporation incurred the following transactions

Q106: At the end of the period, the

Q121: The Mansfield Company manufactures and sells two

Q128: How a particular cost behaves (fixed versus

Q142: During its first year of operations, Silverman