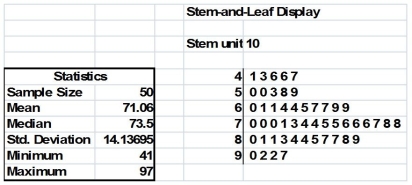

TABLE 2-18

The stem-and-leaf display below shows the result of a survey on 50 students on their satisfaction with their school with the higher scores represent higher level of satisfaction.

-Referring to Table 2-18, if a student is randomly selected, his/her most likely level of satisfaction will be in the 60s among the 40s, 50s, 60s, 70s, 80s and 90s.

Definitions:

Specific Excise Tax

A tax levied on a particular good or service, usually based on a fixed amount per unit, such as per liter of alcohol or per pack of cigarettes.

Unitary

A term in economics used to describe a situation where a change in one factor leads to a proportionate change in another factor.

Price Elasticity

A measure of how much the quantity demanded of a good responds to a change in the price of that good, indicating the sensitivity of consumers to price changes.

Specific Excise Tax

A fixed tax imposed on a specific quantity of a good, regardless of its price, typically applied to items such as alcohol and tobacco.

Q19: If P(A and<br>B) = 1, then A

Q23: Suppose A and B are events where

Q32: After detoxification from substance abuse,the patient says,"I

Q46: Referring to Table 5-7, what is the

Q49: Referring to Table 3-2, the third quartile

Q72: You have collected information on the market

Q79: A professor computed the sample average exam

Q97: The probability that a new advertising campaign

Q149: The interquartile range is a measure of

Q199: Referring to Table 5-5, what is the