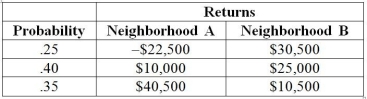

TABLE 5-7

There are two houses with almost identical characteristics available for investment in two different neighborhoods with drastically different demographic composition. The anticipated gain in value when the houses are sold in 10 years has the following probability distribution:

-Referring to Table 5-7, what is the variance of the gain in value for the house in neighborhood A?

Definitions:

Average Tax Rate

The portion of total income that is paid as taxes, calculated by dividing the total amount of taxes paid by the total income.

Tax Liability

The total amount of tax that an individual or business owes to the government, based on their income or revenue.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, representing the percentage of tax applied to your income for each tax bracket in which you qualify.

Average Tax Rate

The ratio of the total amount of taxes paid to the total tax base (taxable income or spending), showing the percentage of income or spending that goes to taxes.

Q57: The smaller the spread of scores around

Q90: Referring to Table 5-8, the table above

Q109: Referring to Table 4-2, what is the

Q126: Eleven freshmen are to be assigned to

Q130: Referring to Table 3-11, how will you

Q140: Referring to Table 5-9, what is the

Q150: Referring to Table 2-13, if a relative

Q164: To use the normal distribution to approximate

Q174: Referring to Table 5-2, the probability that

Q189: For sample size 16, the sampling distribution