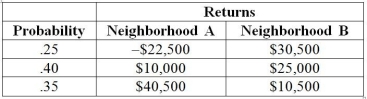

TABLE 5-7

There are two houses with almost identical characteristics available for investment in two different neighborhoods with drastically different demographic composition. The anticipated gain in value when the houses are sold in 10 years has the following probability distribution:

-Referring to Table 5-7, if you can invest half of your money on the house in neighborhood A and the remaining on the house in neighborhood B, what is the portfolio risk of your investment?

Definitions:

Required Return

The minimum yearly interest rate that entices both individuals and companies to invest in a specific security or endeavor.

Share Dividend

A dividend payment made in the form of additional shares rather than a cash payout, often opted by a company to conserve cash.

Start-Up Company

A newly established business, often in the early stage of development, focused on a unique product or service idea.

Desired Rate

The specific rate of return that an investor aims for on an investment.

Q5: Referring to Table 4-9, if a company

Q13: Assume that house prices in a neighborhood

Q20: Referring to Table 5-9, what is the

Q42: A population frame for a survey contains

Q47: The professor of a business statistics class

Q56: The owner of a fish market has

Q114: Suppose A and B are independent events

Q146: Referring to Table 5-7, if you can

Q154: Referring to Table 5-8, if you decide

Q169: Referring to Table 6-2, John's income as