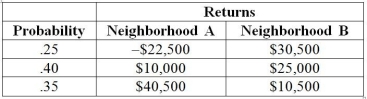

TABLE 5-7

There are two houses with almost identical characteristics available for investment in two different neighborhoods with drastically different demographic composition. The anticipated gain in value when the houses are sold in 10 years has the following probability distribution:

-Referring to Table 5-7, if your investment preference is to maximize your expected return while exposing yourself to the minimal amount of risk, will you choose a portfolio that will consist of 10%, 30%, 50%, 70%, or 90% of your money on the house in neighborhood A and the remaining on the house in neighborhood B?

Definitions:

Q18: The amount of tea leaves in a

Q22: If P(A and<br>B) = 0, then A

Q34: In left-skewed distributions, which of the following

Q56: If the data set is approximately bell-shaped,

Q61: Suppose that past history shows that 60%

Q82: A manufacturer of power tools claims that

Q86: A catalog company that receives the majority

Q118: Referring to Table 3-7, what is the

Q133: What type of probability distribution will the

Q164: To use the normal distribution to approximate