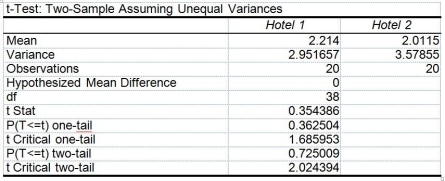

TABLE 10-13

The amount of time required to reach a customer service representative has a huge impact on customer satisfaction. Below is the Excel output from a study to see whether there is evidence of a difference in the mean amounts of time required to reach a customer service representative between two hotels. Assume that the population variances in the amount of time for the two hotels are not equal.

-Referring to Table 10-13, what is the smallest level of significance at which the null hypothesis will still not be rejected?

Definitions:

Q14: Referring to Table 10-10, construct a 90%

Q26: Referring to Table 8-7, the parameter of

Q35: If an economist wishes to determine whether

Q52: A survey claims that 9 out of

Q56: Referring to Table 11-7, the randomized block

Q60: The test for the equality of two

Q71: Referring to Table 13-3, the director of

Q165: Referring to Table 10-3, which of the

Q175: Referring to Table 10-5, you must assume

Q198: Referring to Table 10-14, state the null