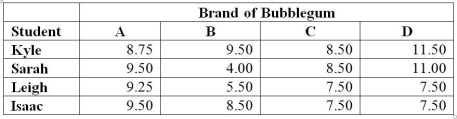

TABLE 11-7

A student team in a business statistics course designed an experiment to investigate whether the brand of bubblegum used affected the size of bubbles they could blow. To reduce the person-to-person variability, the students decided to use a randomized block design using themselves as blocks. Four brands of bubblegum were tested. A student chewed two pieces of a brand of gum and then blew a bubble, attempting to make it as big as possible. Another student measured the diameter of the bubble at its biggest point. The following table gives the diameters of the bubbles (in inches) for the 16 observations.

-Referring to Table 11-7, the decision made at a 0.05 level of significance on the F test for the block effects implies that the blocking has been advantageous in reducing the experiment error.

Definitions:

Accounts Receivable

Amounts due from clients to a business for goods or services already delivered but yet to be paid for.

Income Tax Payable

A liability account on a company's balance sheet representing the amount of income taxes owed to various governmental entities but not yet paid.

Accrued Expenses Payable

Liabilities recorded on the books for expenses that have been incurred but not yet paid.

Accounts Payable

Liabilities of a business that are owed to creditors and suppliers, typically for purchases made on credit.

Q20: Referring to Table 11-8, what is the

Q27: Referring to Table 9-9, which of the

Q29: Referring to Table 13-7, to test whether

Q66: You have created a 95% confidence interval

Q67: Referring to Table 12-5, what is the

Q78: Referring to Table 13-9, the value of

Q90: Referring to Table 13-2, to test whether

Q94: Referring to Table 11-12, the value of

Q121: Referring to Table 9-1, the manager can

Q176: Referring to Table 11-7, the relative efficiency