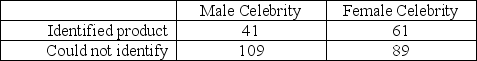

TABLE 12-9

Many companies use well-known celebrities as spokespersons in their TV advertisements. A study was conducted to determine whether brand awareness of female TV viewers and the gender of the spokesperson are independent. Each in a sample of 300 female TV viewers was asked to identify a product advertised by a celebrity spokesperson. The gender of the spokesperson and whether or not the viewer could identify the product was recorded. The numbers in each category are given below.

-Referring to Table 12-9, at 5% level of significance, the conclusion is that

Definitions:

Sales Tax

A tax levied by the government on the sale of goods and services.

Credit Sales

Credit sales are transactions where goods or services are provided to a customer with the agreement that payment will be made at a later date.

Liability Classification

The process of categorizing liabilities on the balance sheet as either current (due within one year) or long-term.

Short-Term Obligation

A debt or other financial obligation that is due to be paid within one year or within the entity's operating cycle if longer.

Q14: When the F test is used for

Q47: If we are testing for the difference

Q50: The analysis of variance (ANOVA) tests hypotheses

Q112: Referring to Table 11-2, what should be

Q114: Referring to Table 12-17, the rank given

Q131: Referring to Table 14-3, what is the

Q148: Referring to Table 10-15, what is(are) the

Q159: Referring to Table 11-5, what are the

Q162: The strength of the linear relationship between

Q164: Referring to Table 11-6, the decision made