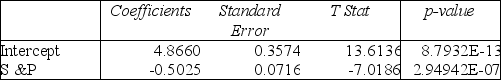

TABLE 13-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500, then it is possible to reduce the variability of the portfolio's return. In other words, one can create a portfolio with positive returns but less exposure to risk.

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 index, is collected. A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance. The results are given in the following Excel output.

Note: 2.94942E-07 = 2.94942*10⁻⁷

-Referring to Table 13-7, to test whether the prison stocks portfolio is negatively related to the S&P 500 index, the measured value of the test statistic is

Definitions:

Müller-Lyer Illusion

A visual illusion where lines of the same length appear to be different lengths due to the orientation of arrow-like figures at their ends.

Culture

The shared values, traditions, norms, customs, arts, history, folklore, and institutions of a group of people that are passed down from generation to generation.

Subconscious Minds

The part of the mind that is not currently in focal awareness but can influence thoughts and behaviors, containing desires and feelings outside of conscious awareness.

Presidential Candidate

A Presidential Candidate is an individual who officially competes for the presidency in an election.

Q15: Referring to Table 12-5, the expected cell

Q18: Referring to Table 11-12, based on the

Q20: Referring to Table 11-8, what is the

Q52: Referring to Table 14-17 Model 1, which

Q60: A multiple regression is called "multiple" because

Q133: Referring to Table 12-12, how many children

Q156: Referring to Table 14-5, what are the

Q161: The sample correlation coefficient between X and

Q179: Referring to Table 14-3, what is the

Q285: Referring to Table 14-7, the department head