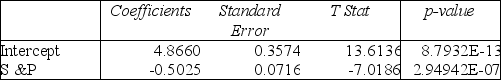

TABLE 13-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500, then it is possible to reduce the variability of the portfolio's return. In other words, one can create a portfolio with positive returns but less exposure to risk.

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 index, is collected. A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance. The results are given in the following Excel output.

Note: 2.94942E-07 = 2.94942*10⁻⁷

-Referring to Table 13-7, to test whether the prison stocks portfolio is negatively related to the S&P 500 index, the p-value of the associated test statistic is

Definitions:

Scored Tablets

Tablets marked with a line, making it easier to split them evenly, often used for adjusting dosages.

Liquid Dosage

A form of medication delivery that involves consuming the medicine in liquid form for ease of swallowing and absorption.

Cutting Device

An instrument or tool designed for cutting materials or objects, differing in form based on its specific use.

Buccal Medication

Medication administered between the gums and the cheek, allowing for absorption through the oral mucosa directly into the bloodstream.

Q11: Referring to Table 11-8, there is evidence

Q15: Referring to Table 13-6, which of the

Q24: In multiple regression, the _ procedure permits

Q28: Referring to Table 12-6, the null hypothesis

Q46: Referring to Table 14-15, which of the

Q56: Referring to Table 12-19, the alternative hypothesis

Q134: Referring to Table 14-5, what is the

Q153: Referring to Table 13-13, the p-value of

Q154: Referring to Table 14-8, the critical value

Q189: Referring to Table 11-3, what is the