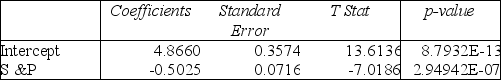

TABLE 13-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500, then it is possible to reduce the variability of the portfolio's return. In other words, one can create a portfolio with positive returns but less exposure to risk.

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 index, is collected. A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance. The results are given in the following Excel output.

Note: 2.94942E-07 = 2.94942*10⁻⁷

-Referring to Table 13-7, to test whether the prison stocks portfolio is negatively related to the S&P 500 index, the measured value of the test statistic is

Definitions:

Differential Analysis

The process of comparing the differences in cost and revenue between different business decisions or scenarios to help in decision making.

Differential Analysis

The process of comparing the costs and benefits of different business decisions or alternatives.

Markup Percentage

The percentage added to the cost of goods to cover overhead and profit, representing the difference between the cost of the product and its selling price.

Product Cost

The total of costs directly attributed to the production of a product, including materials, labor, and manufacturing overhead.

Q5: Referring to Table 13-7, to test whether

Q24: In multiple regression, the _ procedure permits

Q32: Collinearity will result in excessively low standard

Q36: Referring to Table 11-4, the agronomist decided

Q43: Referring to Table 14-17 and using both

Q111: Referring to Table 12-7, there is sufficient

Q139: Referring to Table 14-8, the F test

Q173: Referring to Table 12-3, the null hypothesis

Q296: Referring to Table 14-5, what is the

Q349: Referring to Table 14-17 Model 1, the