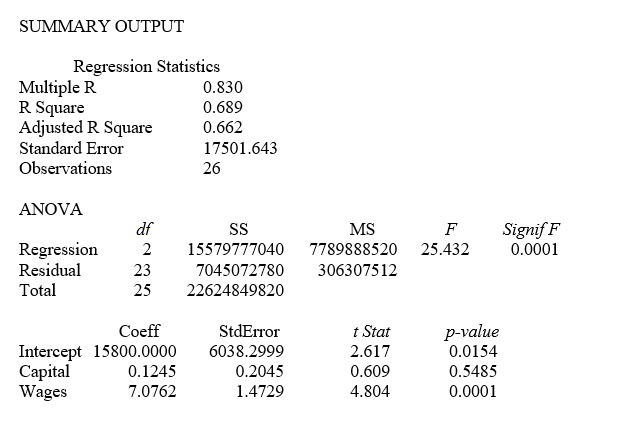

TABLE 14-5

A microeconomist wants to determine how corporate sales are influenced by capital and wage spending by companies. She proceeds to randomly select 26 large corporations and record information in millions of dollars. The Microsoft Excel output below shows results of this multiple regression.

-Referring to Table 14-5, which of the independent variables in the model are significant at the 5% level?

Definitions:

U.S. GAAP

United States Generally Accepted Accounting Principles, the standard framework of guidelines for financial accounting used in the U.S.

Convertible Debt

A type of bond or loan that can be converted into a predetermined amount of the company's equity, usually at the discretion of the debt holder.

LIFO Inventory

An inventory valuation method (Last In, First Out) where the most recently produced or acquired items are the first to be expensed as cost of goods sold, affecting the company's books during periods of inflation.

Bank Overdraft

A facility allowing a bank account holder to withdraw more money than is actually in their account, often used for short-term financing.

Q2: Referring to Table 12-5, there is sufficient

Q12: Referring to Table 14-4, suppose the builder

Q29: Referring to Table 14-17 Model 1, there

Q61: Referring to Table 14-5, what is the

Q81: When using the exponentially weighted moving average

Q93: Referring to Table 12-5, the critical value

Q114: Referring to Table 12-17, the rank given

Q136: Referring to Table 12-5, what is the

Q152: Referring to Table 14-17 Model 1, which

Q270: If a categorical independent variable contains 2