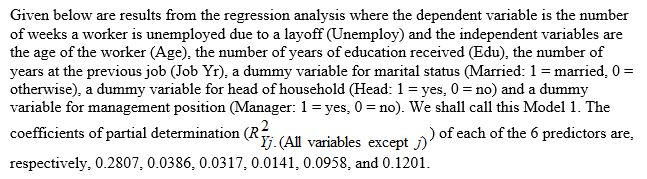

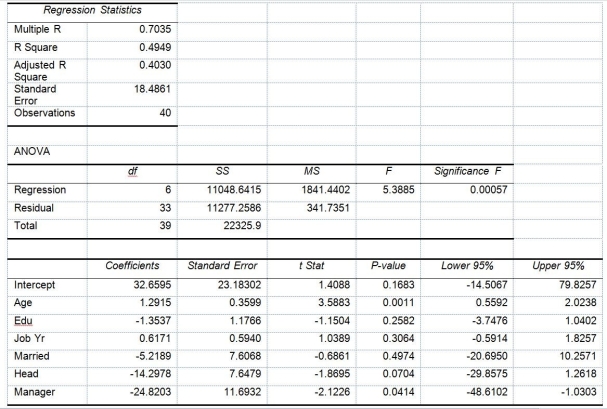

TABLE 14-17

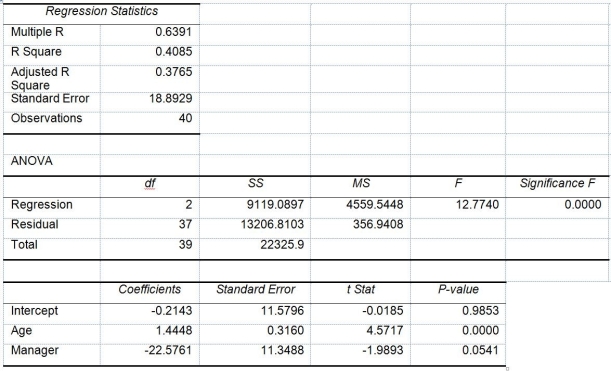

Model 2 is the regression analysis where the dependent variable is Unemploy and the independent variables are

Age and Manager. The results of the regression analysis are given below:

-Referring to Table 14-17 Model 1, what is the p-value of the test statistic when testing whether age has any effect on the number of weeks a worker is unemployed due to a layoff while holding constant the effect of all the other independent variables?

Definitions:

Conditions

Terms or factors that affect or influence the outcome of a situation, often setting the prerequisites or environment in which an event occurs.

Diotima

A figure associated with Socrates in Plato's "Symposium," often depicted as a wise woman or priestess who instructs Socrates on issues of love and beauty.

Plato's Symposium

A philosophical text by Plato in which characters discuss the nature of love through a series of speeches, exploring differing views on eros, love's role, and its value.

Immortality

The ability to live forever or exist eternally without death or decay.

Q32: Collinearity will result in excessively low standard

Q39: If the sample sizes in each group

Q69: Referring to Table 17-4, suppose the supervisor

Q110: Referring to Table 14-15, there is sufficient

Q123: Referring to Table 16-3, if this series

Q177: The residuals represent<br>A) the difference between the

Q207: Referring to Table 14-7, the estimate of

Q254: Referring to Table 14-2, suppose an employee

Q319: Referring to Table 14-17 Model 1, the

Q344: Referring to Table 14-8, the value of