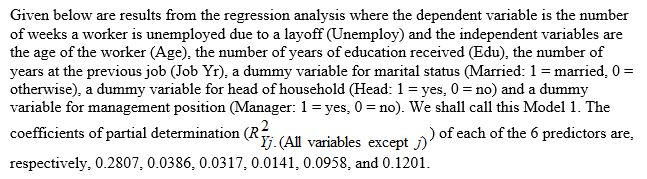

TABLE 14-17

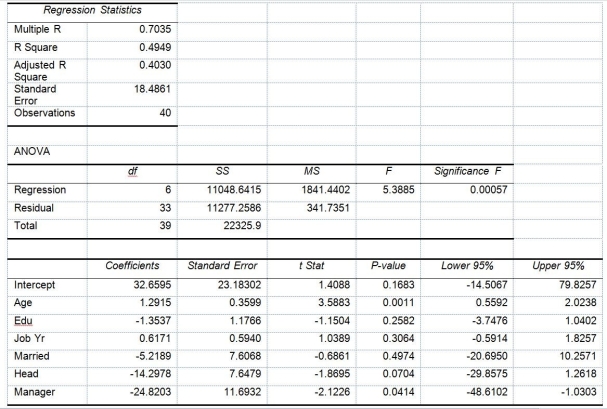

Model 2 is the regression analysis where the dependent variable is Unemploy and the independent variables are

Age and Manager. The results of the regression analysis are given below:

-Referring to Table 14-17 Model 1, the null hypothesis should be rejected at a 10% level of significance when testing whether age has any effect on the number of weeks a worker is unemployed due to a layoff.

Definitions:

Security Market Line

A representation of the capital asset pricing model which shows the relationship between risk (as measured by beta) and expected return of investments.

Expected Return

The anticipated profit or loss an investment is predicted to generate, acknowledging the potential for volatility and risk.

Beta

A means to compare the stability and risk factor of a security or portfolio relative to the market as a whole.

SML (Security Market Line)

A line that represents the expected return of an investment as a function of its risk, with the risk measured by the investment's beta.

Q21: Which of the following best measures the

Q24: Referring to Table 17-5, the best estimate

Q69: Referring to Table 12-20, what is the

Q88: Given a data set with 15 yearly

Q112: Which of the following situations suggests a

Q117: Referring to Table 17-9, based on the

Q124: Referring to Table 13-13, the degrees of

Q194: Referring to Table 14-17 Model 1, the

Q204: Referring to Table 13-3, the director of

Q339: An interaction term in a multiple regression