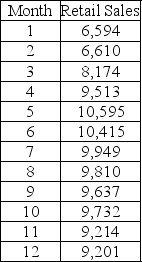

TABLE 16-13

Given below is the monthly time-series data for U.S. retail sales of building materials over a specific year.

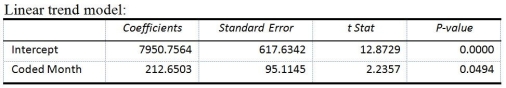

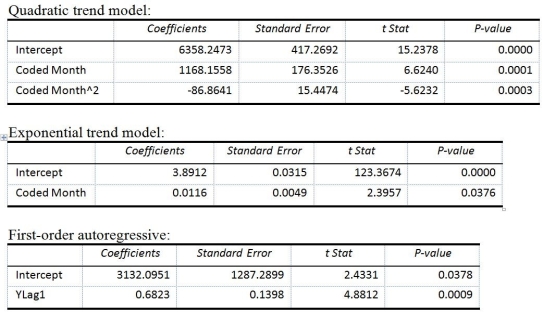

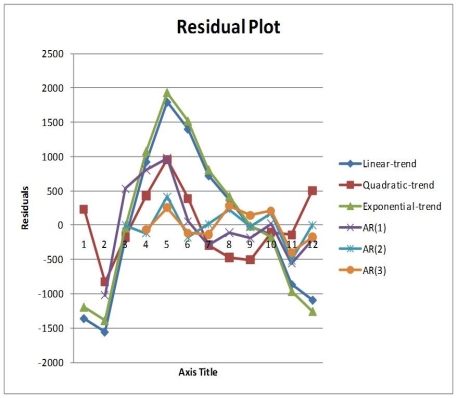

The results of the linear trend, quadratic trend, exponential trend, first-order autoregressive, second-order autoregressive and third-order autoregressive model are presented below in which the coded month for the first month is 0:

-Referring to Table 16-13, what is the exponentially smoothed forecast for the 13ᵗʰ month using a smoothing coefficient of W = 0.25 if the exponentially smooth value for the 10ᵗʰ and 11ᵗʰ month are 9,477.7776 and 9,411.8332, respectively?

Definitions:

Carrying Value

The net book value of an asset or liability on a company's balance sheet, calculated as the original cost minus any depreciation, amortization, or impairment costs.

Bond Discount

is the difference between the face value of a bond and its selling price when the bond is sold for less than its face value.

Straight Line Amortization

A method for calculating the periodic reduction in the carrying amount of an intangible asset, spreading the cost evenly over its useful life.

Par Value Bonds

Bonds issued with a fixed face value that is to be repaid at maturity, often different from their market value.

Q5: Referring to Table 14-15, you can conclude

Q11: The owner of a local nightclub has

Q18: Referring to Table 16-12, to obtain a

Q82: Referring to Table 15-3, suppose the chemist

Q98: Referring to Table 16-13, what is the

Q118: Referring to Table 17-6, a p control

Q147: Referring to Table 16-4, exponentially smooth the

Q159: Referring to Table 14-15, predict the percentage

Q228: Referring to Table 14-15, there is sufficient

Q304: Referring to Table 12-1, the perfume manufacturer